Blogs

“Third-Party Posts”

The following link/content may include information and statistical data obtained from and/or prepared by third party sources that Financial Solutions, deems reliable but in no way does Financial Solutions guarantee its accuracy or completeness. Financial Solutions had no involvement in the creation of the content and did not make any revisions to such content. All such third-party information and statistical data contained herein is subject to change without notice and may not reflect the view or opinions of Financial Solutions. Nothing herein constitutes investment, legal or tax advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Financial Solutions, execution of required documentation, and receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results.

3 Big Retirement Rule Changes Are Coming in 2025—How They Could Affect Your Savings

Key Takeaways Some provisions related to the Secure 2.0, a federal retirement law, will go into effect in 2025. Workers ages 60, 61, 62, or 63 will be able to make...

Retirement Vs. Resignation: Which Is Better?

Retirement Vs. Resignation: Which Is Better? There is a big difference between retirement and resignation. However, both involve leaving your place of work. If you...

6 End-of-Year Retirement Deadlines You Shouldn’t Miss for 2024

Navigate these tax and retirement milestones to optimize savings and avoid penalties. Staying on top of year-end tasks helps you avoid penalties and take full advantage...

Three Changes Coming for Social Security in 2025

The Social Security Administration has announced the 2025 final COLA, wage cap, and amount needed to earn SS credits. Anticipating changes coming to Social Security in...

7 Things You’ll Be Happy You Downgraded in Retirement

Downsizing for retirement is a good way to simplify your life and cut down on expenses. Making some key changes, like moving into a smaller home, could reduce financial...

Key change coming for 401(k) ‘max savers’ in 2025, expert says — here’s what you need to know

Key Points Many Americans face a retirement savings shortfall, but setting aside more could get easier for some older workers in 2025. Enacted in 2022, the Secure Act...

What the Fed’s Rate Cut Means for You

The Federal Reserve just reduced interest rates for the first time in four years. Here’s how it will impact borrowers and saver What goes up must come down, and after...

Social Security COLA 2025: How Much Will Payments Increase Next Year?

With inflation cooling, analysts estimate benefit boost could come in around 2.5% The second of three numbers the Social Security Administration (SSA) will use to...

Why Retirement Gets Better With Annuities

Everyone aspires to have a steady source of income after retirement that replaces as much as possible of their pre-retirement earning. But for many people, one big...

Weekly Market Commentary

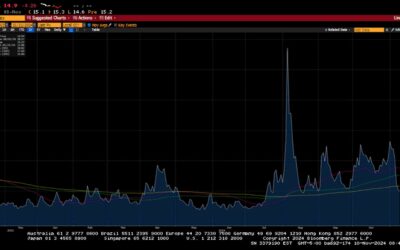

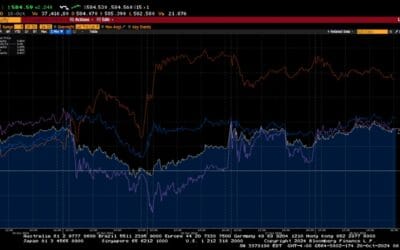

-Darren Leavitt, CFA The Nasdaq eclipsed the 20,000 level for the first time this week as investors reengaged in buying the mega-cap technology names. Amazon, Google,...

Weekly Market Commentary

The S&P 500 forged another set of all-time highs as investors embraced the idea of an economy running at a pace appropriate for the Fed to consider further rate...

Weekly Market Commentary

-Darren Leavitt, CFA The holiday-shortened week saw the S&P 500 and Dow rise to new all-time highs. Investors cheered the nomination of Scott Bessent as Treasury...

Weekly Market Commentary

-Darren Leavitt, CFA Markets bounced back as investors reengaged the pro-growth Trump 2.0 trade. President-elect Trump continued to fill out his cabinet and, late...

Weekly Market Commentary

-Darren Leavitt, CFA US equity markets pulled back last week as investors took profits from the outsized move higher seen following the US election. Sticky inflation...

Weekly Market Commentary

-Darren Leavitt, CFA The S&P 500 notched its 50th all-time high of 2024 as investors piled into equities after a decisive US election. Wall Street embraced the...

Weekly Market Commentary

-Darren Leavitt, CFA It was a very busy week on Wall Street as investors analyzed a deluge of corporate earnings reports and a full economic data calendar. The S&P...

Weekly Market Commentary

-Darren Leavitt, CFA Global markets pulled back last week as investors took the opportunity to reduce some risk before a very close US Presidential election. In the US,...

Weekly Market Commentary

-Darren Leavitt, CFA The S&P 500 advanced for the sixth consecutive week, closing at a new record high. This week, a broadening out of the market’s rally was...

Ed Slott’s Elite IRA Advisor Group (Ed Slott Group) is a membership organization owned by Ed Slott and Company, LLC. Logos and/or trademarks are property of their respective owners and no endorsement of (Taylor Fialkowski) or (Financial Solutions) is stated or implied. Ed Slott Group and Ed Slott and Company, LLC are not affiliated with Financial Solutions.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

4 Things to Know About Rollovers Between Calendar Years

By Sarah Brenner, JD Director of Retirement Education The IRA rollover rules are always tricky. However, if you are rolling over an IRA distribution when the...

The QCD Dance

By Andy Ives, CFP®, AIF® IRA Analyst Tis the season for giving, and qualified charitable distributions (QCDs) are a popular way to donate to a favorite charity....

IRA Rollovers and Roth Contributions: Today’s Slott Report Mailbag

By Sarah Brenner, JD Director of Retirement Education Question: Can a person do a rollover from both his traditional AND Roth IRAs in the same twelve months?...

Who Must Take a 2024 RMD?

By Sarah Brenner, JD Director of Retirement Education The holidays are upon us. There is shopping to do, gifts to wrap, and parties to attend. Amidst the hustle...

The Still-Working Exception and Roth Conversions in an RMD Year: Today’s Slott Report Mailbag

By Ian Berger, JD IRA Analyst Question: If you continue to work past age 73, are you exempt from required minimum distributions (RMDs)? My 73 year-old wife is...

QCD Timing

By Andy Ives, CFP®, AIF® IRA Analyst Year after year, this topic continues to bubble up. Confusion exists over when a QCD can be done in relation to the RMD....

New 401(k) Provisions That Become Effective in 2025

By Ian Berger, JD IRA Analyst Get ready! Several new 401(k) provisions from the SECURE 2.0 Act kick in on January 1, 2025. One that we’ve already written about...

New 401(k) Provisions That Become Effective in 2025

By Ian Berger, JD IRA Analyst Get ready! Several new 401(k) provisions from the SECURE 2.0 Act kick in on January 1, 2025. One that we’ve already written about...

What We Are Thankful for at The Slott Report

Sarah Brenner, JD Director of Retirement Education Each year it is a Thanksgiving tradition here at the Slott Report to take a moment to give thanks for the rules that...

The following link/content may include information and statistical data obtained from and/or prepared by thirdparty sources that Financial Solutions, deems reliable but in no way does Financial Solutions guarantee its accuracy or completeness. Financial Solutions had no involvement in the creation of the content and did not make any revisions to such content. All such third-party information and statistical data contained herein is subject to change without notice and may not reflect the view or opinions of Financial Solutions. Nothing herein constitutes investment, legal or tax advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Financial Solutions, execution of required documentation, and receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

Health Care Access Improving in Rural Areas, Challenges Persist

A new report from the U.S. Department of Health and Human Services’ (HHS) Office of the Assistant Secretary for Planning and Evaluation (ASPE) examines trends in health care access and outcomes in rural America. While insurance rates in these areas are improving,...

Millions See Cost Savings Under the Inflation Reduction Act

The Inflation Reduction Act (IRA) made significant improvements to Medicare prescription drug access and affordability, including by restructuring the Part D benefit to limit enrollee expenses. Those changes began in January 2024, when the IRA eliminated cost sharing...

Healthcare.gov Now Open for 2025 ACA Plan Shopping

Now is the time for people who need health insurance in 2025 to shop for coverage. For those without employer, Medicare, or Medicaid coverage, Healthcare.gov or their state exchange is the place to shop for Affordable Care Act (ACA) plans. Most shoppers will be able...

Watchdog Estimates $7.5 Billion Medicare Advantage Overpayment from “Questionable” Health Risk Assessments

When the Centers for Medicare & Medicaid Services (CMS) pays Medicare Advantage (MA) organizations, they increase the payments when plans enroll sicker people. This is called risk adjustment, and it is an important guardrail to ensure that all people with Medicare...

What If My Medicare Doctor “Opts Out”?

Finding a doctor you like and trust can be a long process, so I understand that it can be frustrating when your doctor no longer accepts Medicare. If your doctor has “opted out” of Medicare, this means that he or she no longer accepts Medicare assignment...

Home health care through Medicare

It’s important to plan for your health care needs, but sometimes life throws unexpected curve balls. And when that happens, you’ll need to know what’s covered. Fortunately, there are ways you and your loved ones can get the necessary care at home. Here’s what you need...

Correcting the Record: The Facts on Medicare Advantage Payment and Accountability

The Wall Street Journal recently published a story regarding diagnoses and plan payments in Medicare Advantage. The story was fundamentally flawed and overlooked the value of Medicare Advantage for millions of American seniors. Here are the facts: More than 33 million...

New bipartisan survey reveals a supermajority of seniors oppose reducing funding to Medicare Advantage — and will factor that into their vote in November

Today, more Americans than ever are choosing Medicare Advantage for affordable, quality health care — with over 33 million seniors and people with disabilities enrolled in the program. BMA wanted to learn more about seniors’ views on Medicare Advantage and how...

How Medicare Advantage In-Home Health Assessments Keep Seniors Healthier

How Medicare Advantage In-Home Health Assessments Keep Seniors Healthier Today, Medicare Advantage delivers affordable, high-quality care to more than 33 million seniors and people with disabilities, with better health outcomes than Fee-for-Service Medicare (FFS). One...

Financial Services

Insurance Services

Educational Blogs

Medicare

Financial Solutions Location

Tulsa, Oklahoma

5100 East Skelly Drive Suite 145

Tulsa, OK 74135

Contact Us: (918) 610-8206

tayfinancialsolutions@gmail.com